As a homeowner in Florida, it’s essential to understand the importance of securing the right insurance coverage for your property. Unpredictable weather and the risks associated with living in the Sunshine State make adequate homeowners insurance protection necessary. As a trusted family-first insurance agency, we at Allied Insurance Group understand the unique needs of our Florida clients and are here to guide you through the process of choosing the ideal coverage for your home.

If you’re considering purchasing or updating your homeowners insurance policy, it’s crucial to know what options are available and how they protect you, your home and your family. This comprehensive guide will provide insight into various homeowners insurance coverage options, giving you the clarity you need to choose the best protection plan tailored to your specific needs.

We will explore essential coverage types, such as dwelling and personal property coverage, as well as important optional coverages like flood insurance and increased limits for valuable items. Understanding these various options will ultimately help you build a policy that adequately safeguards your home and family in the face of unexpected events.

Understanding the Basic Components of Your Homeowners Insurance Policy

As mentioned in the introduction, there are six core coverages found in a standard homeowners insurance policy. These core protections provide a strong foundation to safeguard your property and belongings. However, each homeowner’s situation is unique, and it’s essential to tailor your policy to meet your specific needs. Understanding the scope of each core coverage, as well as its limitations, will help you determine if any optional coverages or endorsements should be added to your policy.

Optional Coverages to Enhance Your Policy

Beyond the core components, there are several optional coverages and endorsements available to provide additional protection for your Florida home. We’ve outlined some popular optional coverages that Florida homeowners should consider.

- Flood Insurance: Traditional homeowners insurance policies generally don’t cover damages caused by flooding. Due to Florida’s geographic location and susceptibility to heavy rainfall and storms, including the possibility of hurricanes, flood insurance is a critical consideration for many homeowners in the state. The National Flood Insurance Program (NFIP), managed by FEMA, offers flood insurance policies to homeowners in participating communities. Additionally, some private insurers offer flood coverage that better suits your needs.

- Windstorm or Hurricane Insurance: While most standard homeowners policies include protection against wind damage, some insurance providers may exclude hurricane-related damages in coastal areas. If this is the case for your policy, it’s important to add a separate windstorm or hurricane endorsement. This ensures you have adequate protection against Florida’s unpredictable weather.

- Increased Limits for Valuable Items: Homeowners insurance policies commonly impose limits on the coverage provided for high-value personal property items such as jewelry, artwork, and collectibles. If your personal belongings exceed these limits, consider adding an endorsement to your policy to increase coverage amounts for specific valuable items.

- Sinkhole Insurance: Florida is well-known for its potential for sinkholes, and standard homeowners policies may not always cover the resulting damages. Many insurers offer optional sinkhole coverage as an endorsement that provides essential protection against this geological hazard.

Factors That Affect Your Homeowners Insurance Rates

It’s important to consider the various factors that impact your homeowner’s insurance premiums. While some factors may be out of your control, others can be actively managed to lessen your policy costs potentially. Common factors that affect premiums include:

- Location: Your home’s proximity to potential hazards such as coastal areas, flood zones, or crime rates can influence premium costs.

- Age and Condition of Home: Newly-built homes and older, well-maintained properties often cost less to insure versus homes in poor condition.

- Home Security and Safety Features: Installing security systems, fire alarms, and other safety equipment can reduce your premiums.

- Deductible Amount: Your chosen deductible amount can impact your premium. A higher deductible generally results in lower premiums but increases your out-of-pocket expenses should you need to file a claim.

- Claim History: A history of frequent claims on your policy can lead to increased rates.

How to Save on Your Homeowners Insurance

Implementing cost-saving strategies can help you secure the best coverage for your home without breaking the bank. Here are a few suggestions to save on your policy:

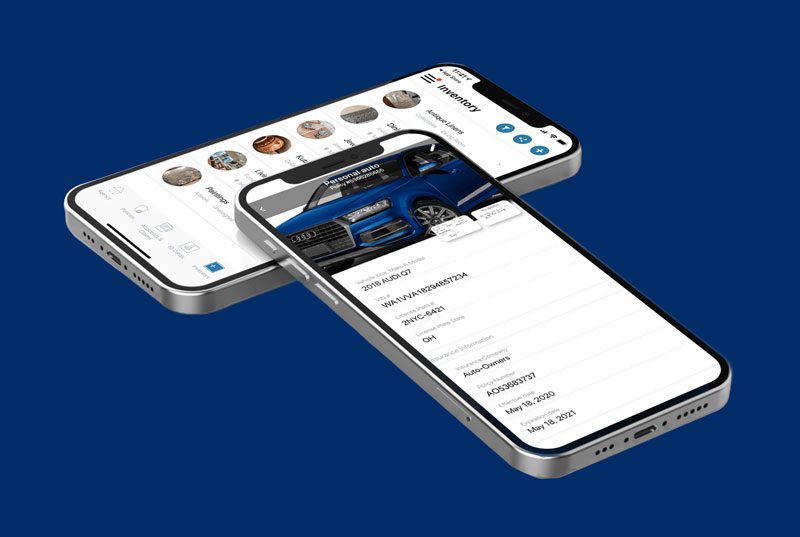

- Bundle Your Policies: Many insurers offer discounts for bundling your homeowners policy with other insurance products, such as auto or life insurance.

- Shop Around: Obtain quotes from multiple insurance providers to compare coverage options and pricing.

- Take Advantage of Discounts: Discuss potential discounts with your insurer, such as loyalty discounts or reductions for home improvements.

- Reassess Your Coverage Annually: Make it a habit to review your policy annually and adjust coverage limits based on your current needs. Removing unnecessary coverage can result in lower premiums.

Conclusion

Finding the right homeowners insurance for your Florida property doesn’t have to be daunting. With a comprehensive understanding of the various protection options available, including optional coverages tailored to your home’s unique needs, you can confidently navigate the insurance landscape. By considering flood, windstorm, sinkhole, and other optional coverages, you’ll safeguard your home and family against the unique risks present in the Sunshine State. Feel free to seek professional guidance from experienced insurance agents to ensure you have the best protection plan for your home. Reach out to Allied Insurance Group for personalized guidance and expertise on Florida homeowners insurance options.